2023 Real Estate Taxes: $1,066.17

2023 Tax Statement: SW4 Sec 16

Deeded Acres: 160 +/-

FSA Cropland Acres: 144.04

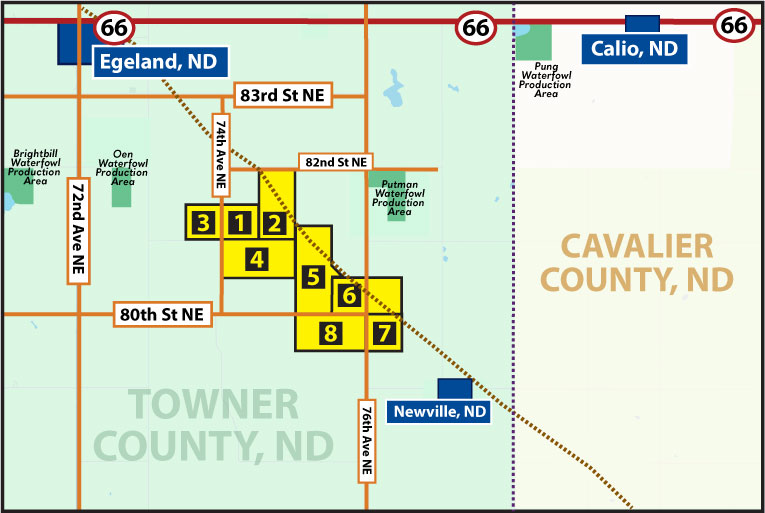

The Zelda Rinas Family Trust land is a beautiful and productive farm located southeast of Egeland, ND in Towner County, ND. All parcels are contiguous with rolling topographies.

This property boasts 2,054.87 +/- acres of fantastic cropland, strong soils, strong base acres and hunting land. There is a US Fish and Wildlife Easement recorded on part of the property. Additionally, there is no 2025 cropping contract. The sellers are reserving 50% of the owned subsurface minerals.

*Property will be sold as eight (8) parcels.

*The 2024 real estate taxes will be paid by the seller(s).

*Property will be sold free of a 2025 cropping contract.

*Seller(s) will retain 50% of the owned subsurface minerals.

*10% earnest money due on sale day.

Legal: SW 1/4 Section 16, T159N, R65W (Victor Twp)

2023 Real Estate Taxes: $1,066.17

2023 Tax Statement: SW4 Sec 16

Deeded Acres: 160 +/-

FSA Cropland Acres: 144.04

Base Acres & PLC Yields: Wheat 123.65 ac, 48 bu; Sunflowers 34.33 ac, 1,361 lbs; Soybeans 38.98 ac, 23 bu;

Barley 27.12 ac, 68 bu; Canola 136.52 ac, 1,691 lbs *Base acres and yields include Parcels 1, 2, 5.

*FSA will have the final determination on prorating the base acres and yields.

Legal: NE 1/4 & SE 1/4 Section 16, T159N, R65W (Victor Twp)

2023 Real Estate Taxes: $2,383.83

2023 Tax Statements: NE4 Sec 16 SE4 Sec 16

Deeded Acres: 309.74 +/-

FSA Cropland Acres: 297.20

Base Acres & PLC Yields: Wheat 123.65 ac, 48 bu; Sunflowers 34.33 ac, 1,361 lbs; Soybeans 38.98 ac, 23 bu;

Barley 27.12 ac, 68 bu; Canola 136.52 ac, 1,691 lbs *Base acres and yields include Parcels 1, 2, 5.

*FSA will have the final determination on prorating the base acres and yields.

Legal: SE 1/4 Section 17, T159N, R65W (Victor Twp)

2023 Real Estate Taxes: $1,293.16

2023 Tax Statement: SE4 Sec 17

Deeded Acres: 160 +/-

FSA Cropland Acres: 149.91

Base Acres & PLC Yields: Wheat 42.41 ac, 48 bu; Sunflowers 11.77 ac, 1,361 lbs; Soybeans 13.37 ac, 23 bu;

Barley 9.30 ac, 68 bu; Canola 46.83 ac, 1,691 lbs

*FSA will have the final determination on prorating the base acres and yields.

Legal: NW 1/4 & NE 1/4 Section 21, T159N, R65W (Victor Twp)

2023 Real Estate Taxes: $2,535.46

2023 Tax Statements: NW4 Sec 21 NE4 Sec 21

Deeded Acres: 320 +/-

FSA Cropland Acres: 313.55

Base Acres & PLC Yields: Wheat 88.70 ac, 48 bu; Sunflowers 24.62 ac, 1,361 lbs; Soybeans 27.96 ac, 23 bu;

Barley 19.45 ac, 68 bu; Canola 97.94 ac, 1,691 lbs

*FSA will have the final determination on prorating the base acres and yields.

Legal: S 1/2 SW 1/4 Section 15, NW 1/4, and SW 1/4 and land S of Railroad in NE 1/4 Section 22, T159N, R65W (Victor Twp)

2023 Real Estate Taxes: $3,331.33

2023 Tax Statements: S2SW4 Sec 15 land E of RR S2SW4 Sec 15 land W of RR NW4 Sec 22 SW4 Sec 22 Land S of RR in NE4 Sec 22

Deeded Acres: 402.50 +/-

FSA Cropland Acres: 383.61

Base Acres & PLC Yields: Refer to Chart *Base acres and yields include Parcels 1, 2, 5.

*FSA will have the final determination on prorating the base acres and yields.

Legal: SE 1/4 Section 22 & SW 1/4 Section 23, T159N, R65W (Victor Twp)

2023 Real Estate Taxes: $2,557.13

2023 Tax Statements: SE4 Sec 22 SW4 Sec 23

Deeded Acres: 310.09 +/-

FSA Cropland Acres: 310

Base Acres & PLC Yields: Refer to Chart *Base acres and yields include Parcels 6 & 8.

*FSA will have the final determination on prorating the base acres and yields.

Legal: NW 1/4 Section 26, T159N, R65W (Victor Twp)

2023 Real Estate Taxes: $1,267.73

2023 Tax Statement: NW4 Sec 26

Deeded Acres: 156.55 +/-

FSA Cropland Acres: 142.97

Base Acres & PLC Yields: Wheat 40.44 ac, 48 bu; Sunflowers 11.23 ac, 1,361 lbs; Soybeans 12.75 ac, 23 bu;

Barley 8.87 ac, 68 bu; Canola 44.66 ac, 1,691 lbs

*FSA will have the final determination on prorating base acres and yields.

Legal: NW 1/4 & NE 1/4 Section 27, T159N, R65W (Victor Twp)

2023 Real Estate Taxes: $2,689.92

2023 Tax Statements: NW4 Sec 27 NE4 Sec 27

Deeded Acres: 320 +/-

FSA Cropland Acres: 304.11

Base Acres & PLC Yields: Wheat 91.59 ac, 48 bu; Sunflowers 25.43 ac, 1,361 lbs; Soybeans 28.88 ac, 23 bu;

Barley 20.09 ac, 68 bu; Canola 101.13 ac, 1,691 lbs *Base acres and yields include Parcels 6 & 8.

*FSA will have the final determination on prorating base acres and yields.

418 Main St. | PO Box 7 | Cando, ND

204 Hwy #2 W, Ste B | Devils Lake, ND

© 2024 Nikolaisen Land Company. All Rights Reserved